How to use our health insurance comparison tool

The Health Insurance Authority (HIA) is the State body that regulates the private health insurance market in Ireland. We provide impartial information about health insurance to the public, and we have a free online health insurance comparison tool.

Our comparison tool is independent and impartial . It will make it easier for you to understand your options and choose a health insurance plan.

Who is the comparison tool for?

Anyone can use our comparison tool. You can use the tool to help with the following:

- You currently have health insurance and you want to check if you’re on the best plan for your needs

- You don’t currently have health insurance and you want to explore your options available in the market

- You want to help a friend or family member find a new plan.

How does the comparison tool work?

The comparison tool gives you the best options based on your own specific health insurance needs and requirements. In order to do this, you will be asked to rank nine different health insurance coverage areas from most to least important to you. This helps the tool understand what you’re looking for.

Next, the tool will ask you to choose between the different levels of cover for each of your preferred coverage areas, with reference to the potential cost. This helps us understand the amount of cover you want and what your budget is.

When we know enough about what you’re looking for, you will be shown the most suitable plans for you based on your answers. You can then read about the different benefits, differences, and exclusions in these plans and decide which one is best for you.

How to Use the Health Insurance Comparison Tool

Read our Step-by-Step Guide to using the Health Insurance Comparison Tool.

Prefer a printable version? Download the text-only version of our Step-by-Step Guide to using the Health Insurance Comparison Tool (PDF). This version contains the same instructions without screenshots and is suitable for printing or offline use.

Step 1: Get Started

- Go to www.hia.ie/health-insurance-comparison

- Click Compare health insurance.

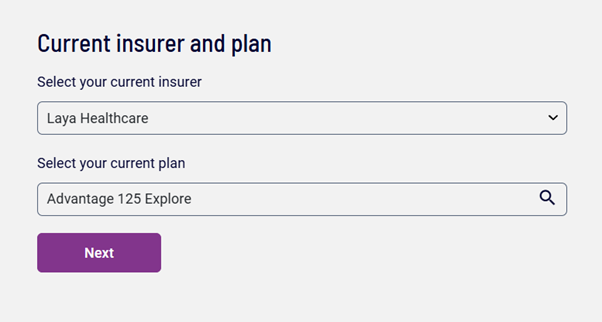

Step 2: Tell Us About your Current Cover

You’ll be asked if you currently have health insurance.

- Select No if you don’t have health insurance,

- Select Yes if you do, then select your insurer from the dropdown list and start typing the name of your current plan.

- When you’re ready, click Next to continue

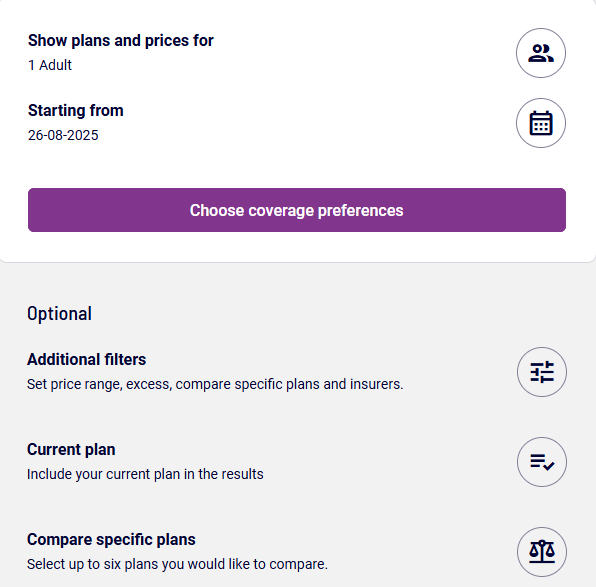

Step 3: Choose Who’s Covered and When

The tool starts with one adult and today’s date by default.

To change this:

- Click person icon to add more people

- Click the calendar icon to choose the start date.

Step 4: Filter Your Options

Click the Additional filters icon to set:

- Your preferred price range

- Your preferred payable excess.

Use the Advanced options to:

- Search for specific insurers

- Compare specific plans

- Compare only selected plans

If you already know the names of the plans you want to compare (for example, your current plan and a previous one), type in the plan names and tick the box that says “Compare only these plans” when the pop-up appears. This will bring you directly to a comparison page showing just the plans you’ve selected.

When you’re ready, click Choose coverage preferences.

Note: These additional filters are also available at the end of your search.

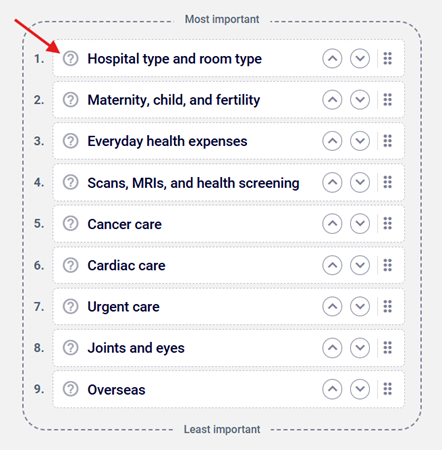

Step 5: Set Your Coverage Priorities

- You’ll see a list of 9 coverage areas (for example everyday health expenses, hospital room and type, and joints and eyes.)

- Click the question mark icon next to learn more about what is included in each coverage area.

- Drag and drop or use the arrow buttons to rank them in order of importance to you. For example, if your top priority on a health insurance plan is the type of hospital covered and the room type, move “Hospital room and type” to the top of the list. Do the same thing for your second most important coverage area and so on, in order of importance.

- Once you’re happy with the order, select Done.

Comparing plans

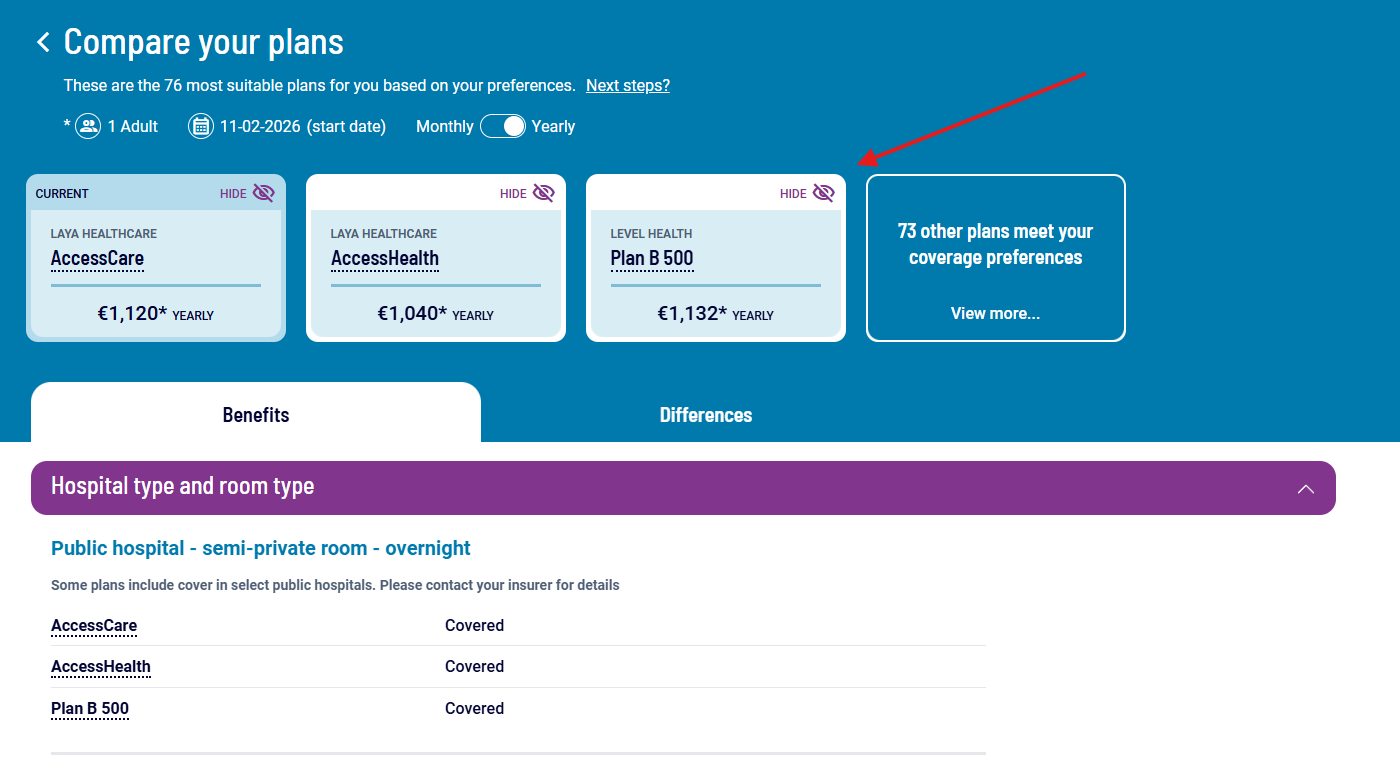

Step 1: View Your Matches

- Based on your preferences, we’ll show you the most suitable plans for you based on your choices.

- Plans are ordered by price and the first three are usually highlighted for easy comparison.

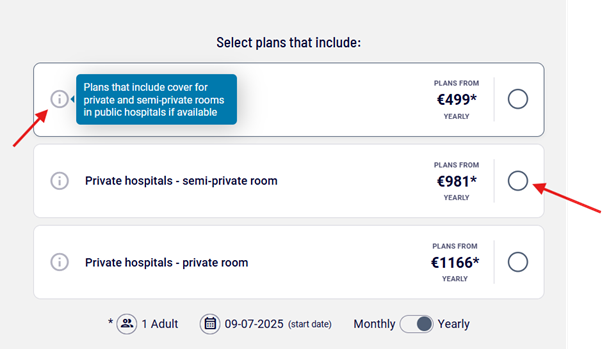

Step 6: Pick Your Cover Level

- For each coverage area, choose how much coverage you want.

- Click information icon to learn more about the different levels of cover.

- The price shown is the starting price for plans with that level of cover.

- Select the level of cover that best fits your needs and budget.

Step 2: Refine Your Results

Use the Additional filters icon on this page to set your preferred price range and excess and Advanced options to search for plans from a specific insurer or to compare specific plans.

Step 3: See Your Current Plan

If you have health insurance, your current plan will appear alongside the other plans that meet your preferences.

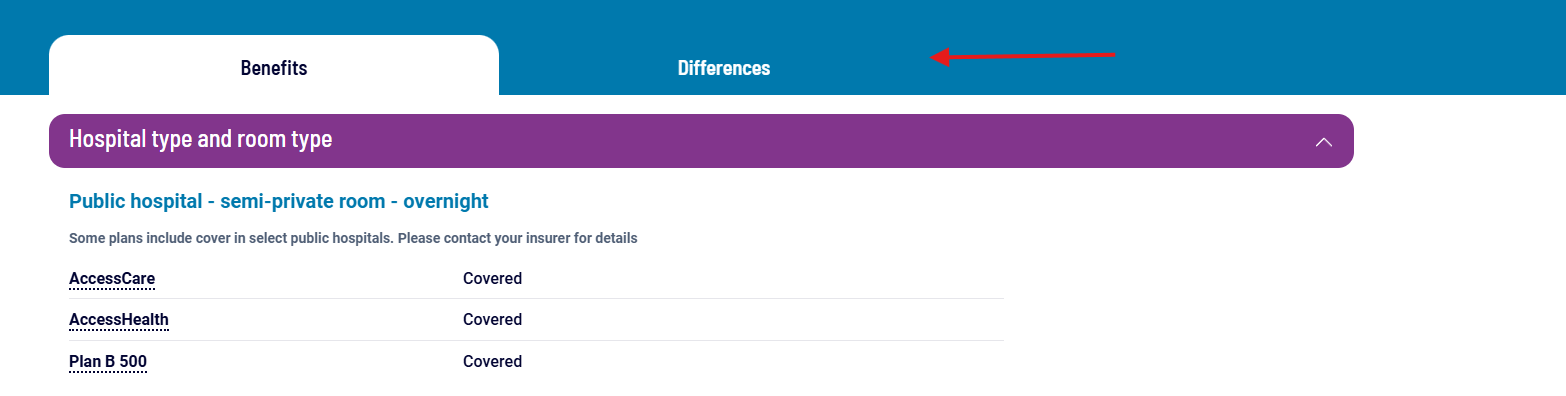

Step 4: Explore the Details

- Click the Benefits tab to see what each plan includes.

- Click the Differences tab to see which benefits are unique to each plan.

Step 5: See Full Plan Information

- Click the plan name to view full details.

- This will bring you to the plan page, where you’ll will also find a link to the insurer's website.

- We strongly recommend contacting the insurer directly to find out the exact benefits, terms and conditions of any plans you are interested in before making a decision.

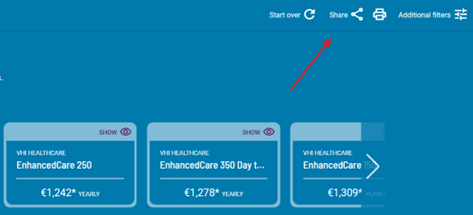

Step 6: Compare or Remove Plans

- Use the eye icon to show or hide it. You can add multiple plans for comparison.

Step 7: Start over or Share

Use the icons in the top right corner to:

- Start over

- Print your comparison

- Share it

Disclaimer:

This comparison tool is a guide only.

The Health Insurance Authority provides this comparison tool to assist consumers in comparing private health insurance products available in the Republic of Ireland. It is intended solely for informational purposes and does not constitute legal, financial, or professional advice.

The data presented on this website is submitted by regulated insurers and is published by the HIA following a quality assurance process undertaken by the HIA. While reasonable endeavours are made by the HIA to ensure the accuracy and timeliness of the information, the HIA does not accept liability for any loss, damage, or inconvenience arising from reliance on the data provided.